Navigating September Volatility: Ethereum, Bitcoin, and Real Estate Insights

Unlock the Top Pick of the Week

It’s no secret - September is often a brutal month for investors, and this year is no exception. As we head into the Federal Open Market Committee (FOMC) meeting (in 3 days), the markets are already pricing in a rate cut, and we’ve been seeing plenty of red across the board.

What’s Going On?

Bitcoin is hanging out in the $50K to $60K range, gold approaching $2,600, and all three major U.S. indices had their worst week this year. But as savvy investors, we need to dig deeper into these swings and mixed signals.

Media reported a potential Nvidia antitrust investigation that led to a historic stock drop, which was denied the next day.

The U.S. unemployment rate is falling, but hiring has slowed down.

Treasury Secretary Janet Yellen says the U.S. economy is "solid," yet experts warn of a weakening consumer base.

$6.3 trillion sits in money market funds, sparking debate: bullish or bearish?

Here's a quick look at the S&P500 previous week:

Overall, September is doing September things: confusing and scaring investors, fueling doubt and sending people back to the drawing board, revisiting their thesis, and giving more thought to "what if I'm wrong'"

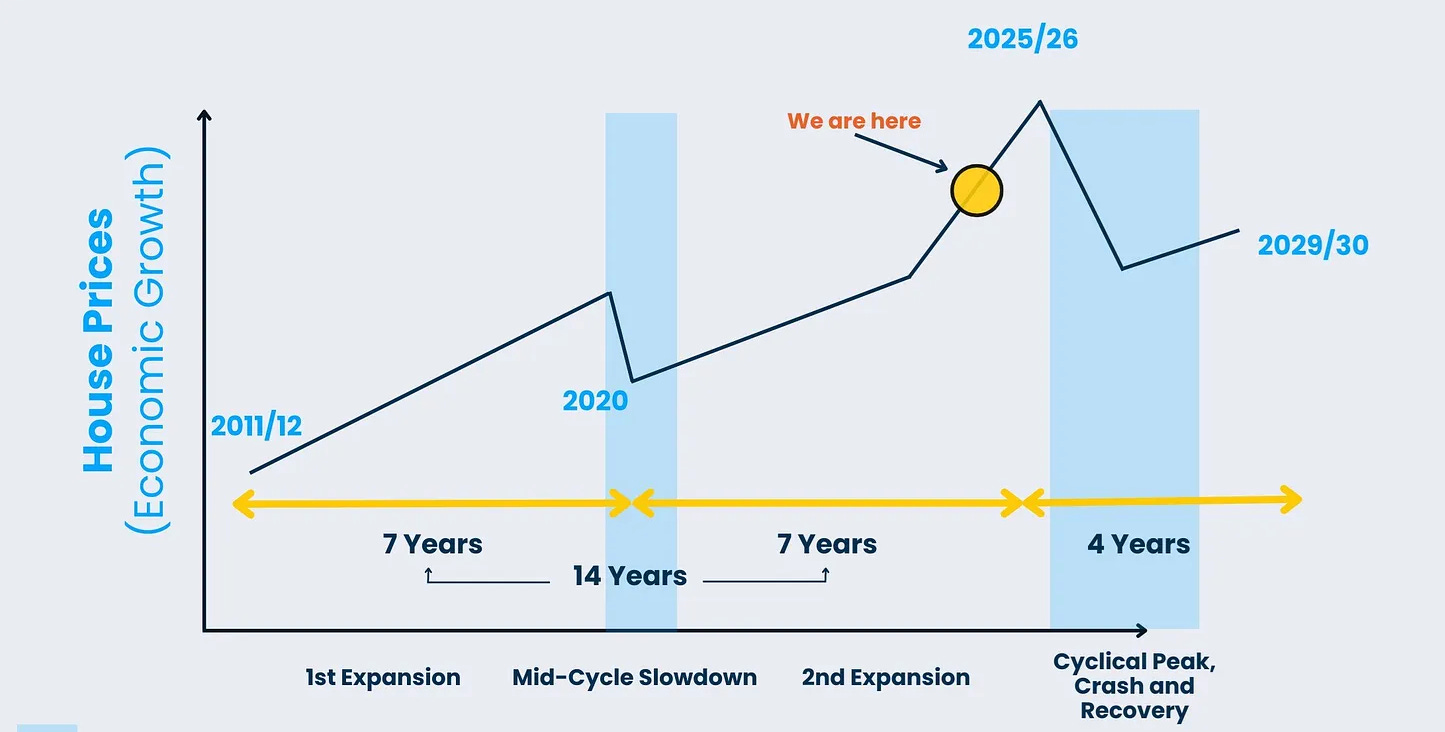

On our end, the road remains clear: no invalidation was hit. We are progressing into the Winner's Curse, and the current bull market may well last another year or more (subject to regular monitoring and updates).

In the midst of all this uncertainty, it’s natural to doubt. But as always, we stay the course. No invalidation hit. The current bull market could last another year, so buckle up.

Join ByBit and receive upto $6,045 in Rewards!

Ready to elevate your trading game? Here’s your chance.

Open a Crypto Exponentials x ByBit trading account.

Fund your account with $100 or more (or crypto equivalent).

Join paid subscription for tips and tricks to grow your account this bull run

You’ll get:

Access strategies to build $10k/month passive income.

Subscriber-only posts and full archive. 10% of the fees goes to the charities.

Access Crypto Spot/Leverage/Options Trading educational series.

Bitcoin: September Insights

Historically, Bitcoin has a pattern of printing its monthly low around the 15th and then finishing strong by month’s end. Interestingly, in election years, Bitcoin has never broken its September low in October—though this only applies to three years of data. Still, it’s useful context.

BTC Weekly Chart previous week

Blue Line = 20-Week Moving Average, Pink Line = 50-Week Moving Average, Yellow Line = 200-Week Moving Average

The goal for Bitcoin bulls? Watch for BTC to form a swing low above its August 5 bottom and push past $61,500.

In other news:

Bitcoin ETFs saw over $1 billion in outflows since August 27.

Zurich Cantonal Bank now offers Bitcoin and crypto trading to its 1.5 million customers.

Ethereum and the Future of Blockchain: Ecosystem Update

Ethereum's Rollercoaster Year: Challenges and Opportunities

The Ethereum ecosystem has been navigating through a complex landscape over the past year. Despite achieving mainstream adoption through traditional finance (TradFi), with significant milestones such as the launch of Ethereum spot ETFs in the U.S. and traditional institutions like BlackRock building on-chain funds, Ethereum’s dominance in the crypto space has been slipping. But why?

Mainstream Success But Declining Dominance

Although Ethereum has steadily recovered since the crypto market’s bottom at the end of 2022, producing solid gains, its dominance has waned due to increasing competition and the rise of alternative blockchain ecosystems. High gas fees and network congestion during Ethereum’s earlier phases led users to explore layer-2 scaling solutions like Optimism, Polygon, and Arbitrum, as well as alternative layer-1 blockchains like Solana and Avalanche.

NFTs, Memecoins, DeFi, and DePin protocols have migrated to other ecosystems, chipping away at Ethereum’s market share. Despite this, Ethereum remains the largest ecosystem within Web3. However, the market cycle may soon flip in Ethereum's favor as historical patterns suggest that when Bitcoin's dominance dips, Ethereum and other altcoins often take the lead.

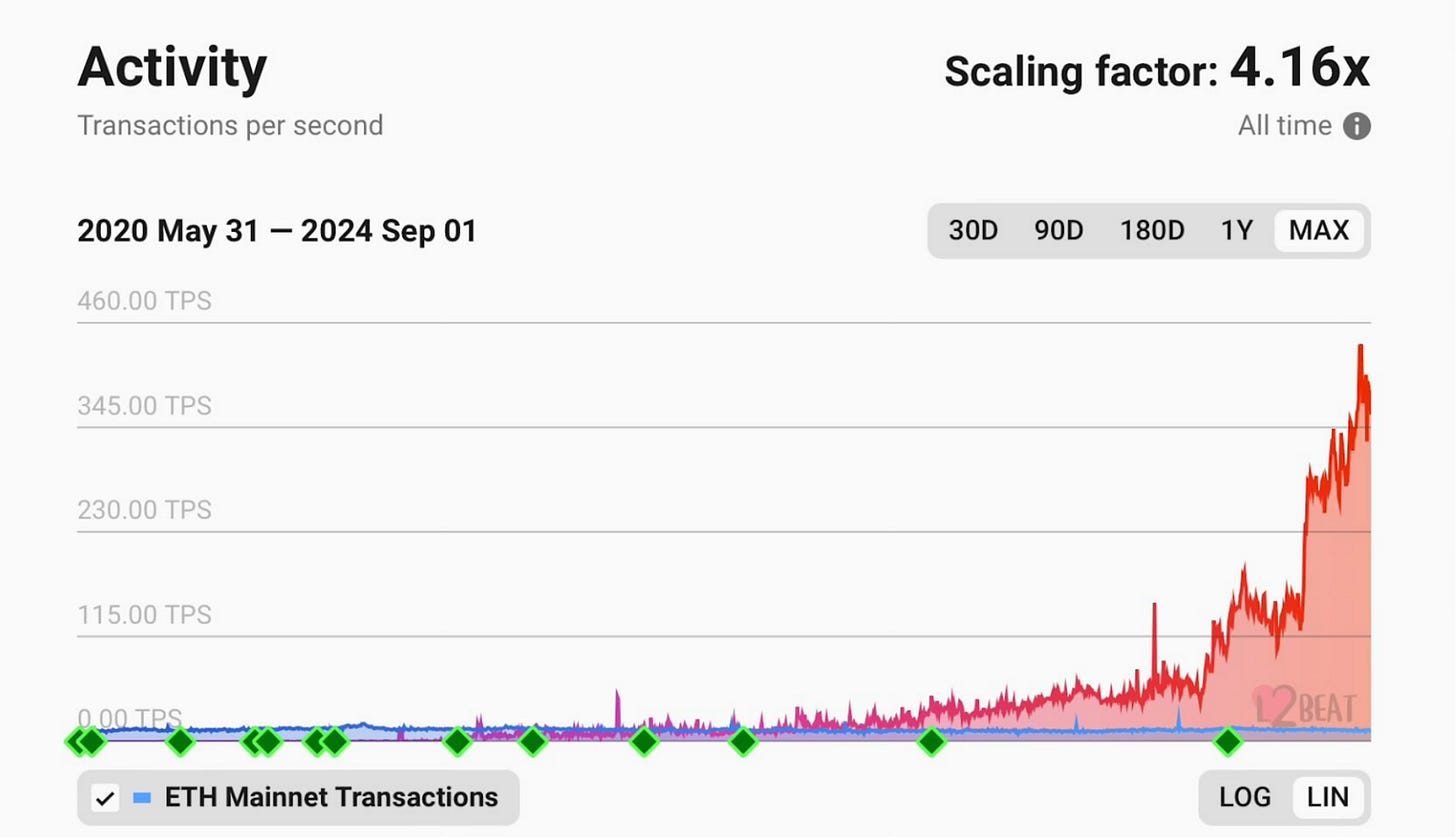

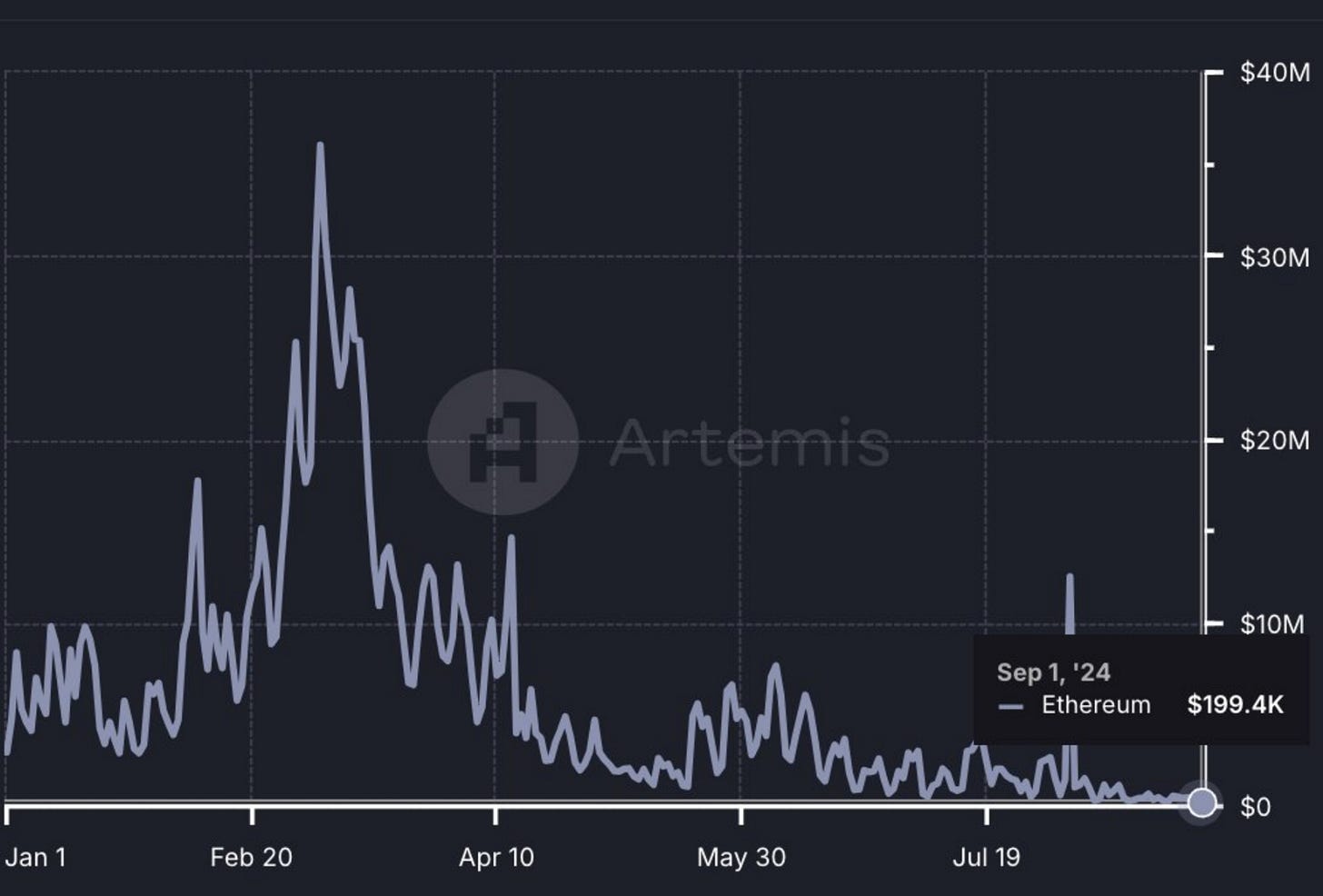

Ethereum's Growing Activity vs. Plunging Revenue

Ethereum’s recent activity levels have reached all-time highs, but interestingly, its revenue has plummeted by 90%. Why? The dramatic reduction in gas fees, which have dropped by over 90%, has shifted Ethereum from a deflationary asset to an inflationary one. Ethereum’s high gas fees previously contributed significantly to its revenue, so with lower fees, the network is naturally generating less income.

Yet, this isn’t necessarily a bad thing. The Ethereum development team anticipated this outcome as part of their goal to make the network more scalable and accessible to the masses. The focus has been on solving Ethereum’s most pressing challenges—transaction speed, cost, and scalability — leading to an influx of activity even as revenue shrinks.

What’s Coming Next: The Pectra Upgrade

Ethereum’s future looks bright with the upcoming Pectra upgrade slated for late 2024 or early 2025. This significant update aims to address transaction costs, scalability, and user experience, which are vital for mass adoption. Key components of the Pectra upgrade include:

EIP-3074: Simplifies user interactions by allowing multiple transaction tasks to be grouped into a single, signed transaction. This reduces complexity, lowers gas fees, and improves overall user experience for decentralized applications (dApps).

Social Recovery for Wallets: Reduces anxiety around lost seed phrases by allowing users to designate trusted contacts for wallet recovery.

Verkle Trees: A new data structure that reduces storage needs, enabling faster data access and better scalability.

EIP-7692: Enhances the Ethereum Virtual Machine (EVM), optimizing smart contract execution, making it cheaper and easier for developers to deploy dApps.

These improvements are part of Ethereum’s ongoing journey to solve the “blockchain trilemma” of decentralization, security, and scalability. The Pectra upgrade not only makes Ethereum more efficient and scalable but also enhances user and developer experience, ensuring it remains competitive as new blockchain platforms emerge.

Ethereum’s Dominance: A Strategic Pause Before the Next Move

While Ethereum’s dominance has decreased in recent years, this is a natural ebb and flow within the crypto market. Ethereum is laying the groundwork for its next leap with innovations designed to maintain its status as the most powerful and flexible blockchain. Investors should keep an eye on Ethereum’s dominance metrics, such as ETH/BTC and BTC.D, to assess the optimal time for increased exposure.

The Long-Term Outlook for Ethereum

As Ethereum continues its evolution with upgrades like Pectra and the future Fusaka update, it is preparing to dominate Web3 applications ranging from finance to gaming. Ethereum’s role as the backbone of decentralized technology seems secure for now, as it addresses the critical challenges of scalability, cost, and usability.

With improvements in validator operations, transaction processing, and smart contract efficiency, Ethereum will not just keep pace with its competitors—it will lead the charge toward a more decentralized, accessible internet.

Coin of the Week:

Join paid subscription to access »

Keep reading with a 7-day free trial

Subscribe to Crypto Alpha to keep reading this post and get 7 days of free access to the full post archives.