Bitcoin! C'mon, Do Something

Hello, Crypto Enthusiasts!

This week has been a bit of a "pancake" in the crypto world—mostly flat with some minor fluctuations. But while the market itself might be stable, the broader crypto landscape is anything but boring. Let’s dive into this week’s key highlights:

Bitcoin Analysis:

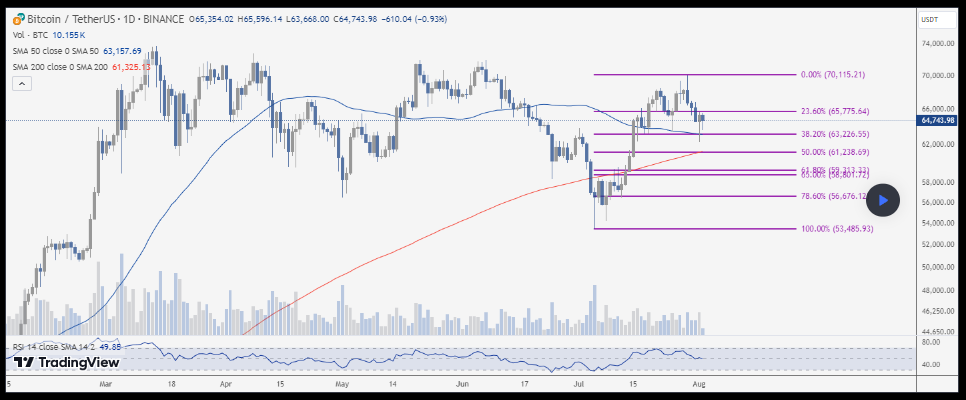

Bitcoin has experienced notable volatility recently. After hitting a low of $53,485 a month ago on Binance, the cryptocurrency surged to $70,115 before settling around $62,000.

Technical Overview: Fibonacci retracement levels from this recent rally indicate a healthy pullback. We're currently above the 50% retracement but have yet to test the golden pocket at 61.8%. If Bitcoin bounces from here, this would suggest a relatively shallow correction.

Summary: The current movement suggests sideways price action with no major concerns. However, altcoins remain underperforming, and I recommend staying cautious in this environment.

Legacy Markets Update: Nasdaq and Broader Trends

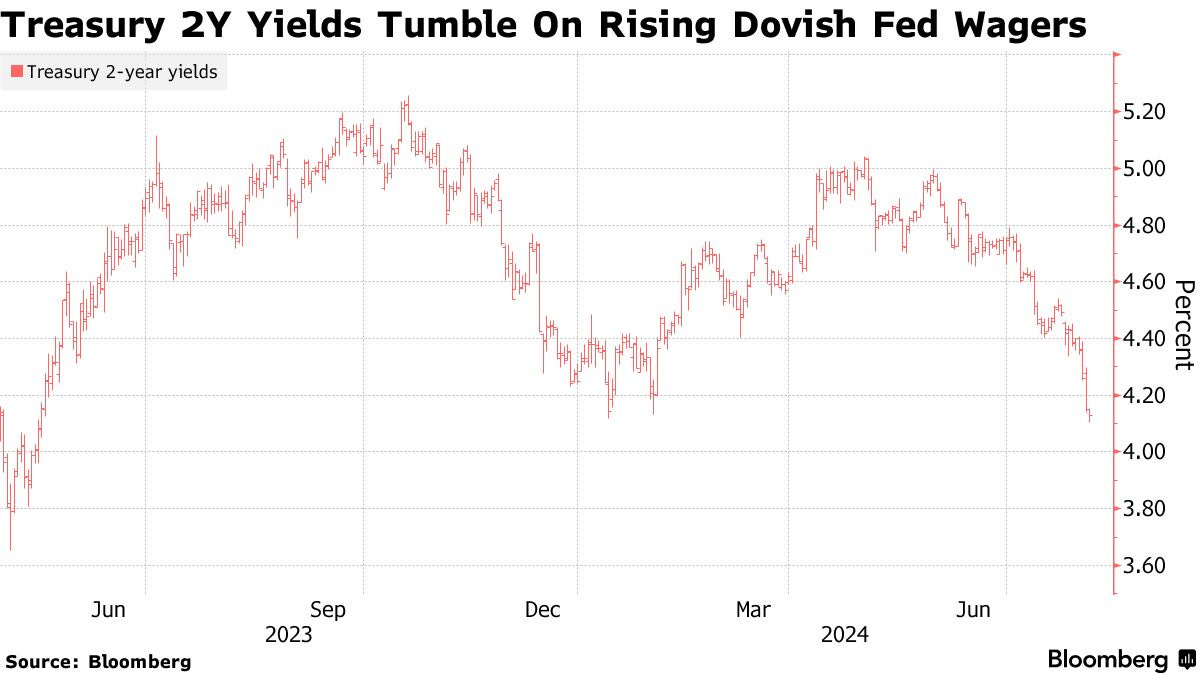

The global stock selloff has deepened, with Nasdaq 100 Index futures dropping 1.8% as worries grow that the Federal Reserve has been too slow in adjusting interest rates. Disappointing earnings reports from major tech firms have added to market anxiety. The upcoming monthly jobs report is expected to show slower job growth, further impacting market sentiment. Fed Chair Jerome Powell has hinted at rate cuts in September, but some investors are pushing for more immediate action to mitigate a potential economic slowdown.

Market Movements:

S&P 500 contracts fell 1.1%.

Japan's Topix saw its worst decline since 2016.

Treasuries rallied for the seventh consecutive day, with the two-year yield dropping to its lowest in 14 months.

Dollar weakened.

Corporate Earnings:

Amazon.com Inc. slid 8.7% in premarket trading due to rising costs for AI services.

Intel Corp. dropped over 22% following a poor growth forecast and plans to cut 15,000 jobs.

Snap Inc. fell 17% as revenue missed estimates.

Jobs Report Outlook: The anticipated monthly US jobs report is expected to show moderating job and wage growth for July. A Bloomberg survey estimates a rise of 175,000 payrolls, down from June’s 206,000 increase. Gary Dugan of Global CIO Office suggests discussions may arise about a potential 50-basis-point rate cut at the next Fed meeting to address economic momentum loss.

Additional Factors:

Lackluster earnings from major tech firms like Microsoft and Amazon.

Concerns over the slow recovery of the Chinese economy.

Reduced excitement over AI developments.

Escalating tensions in the Middle East following recent geopolitical events.

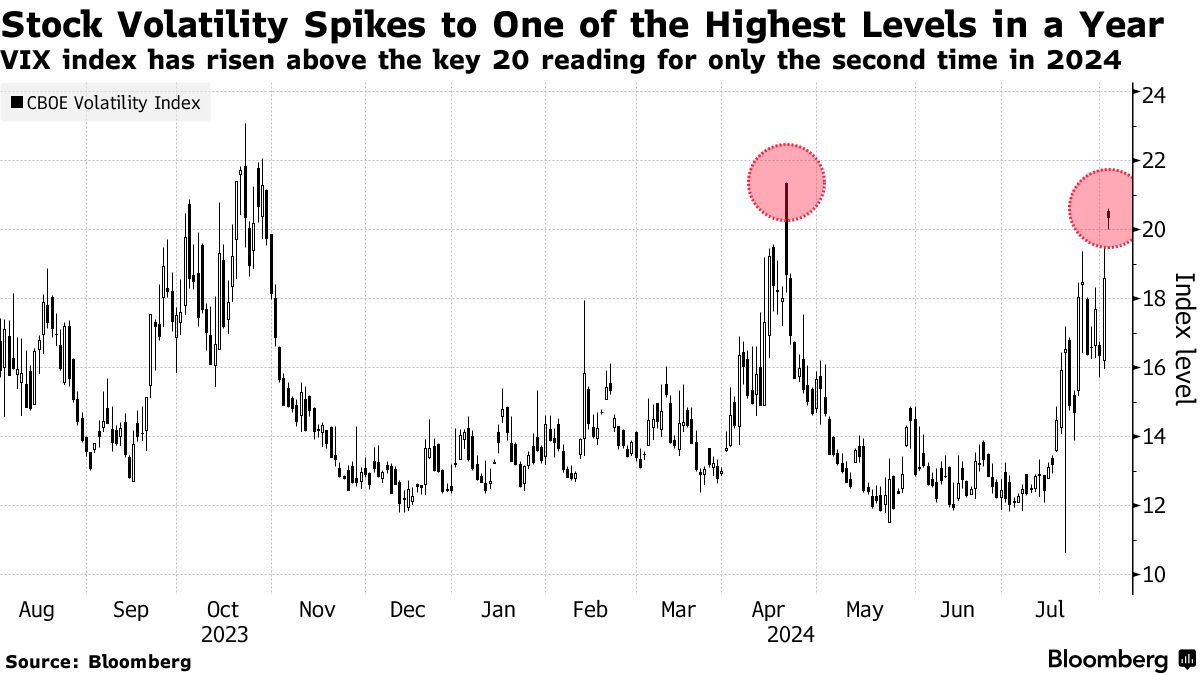

Future Expectations: Markets are pricing in the possibility of three consecutive quarter-point rate cuts in September, November, and December, with over a 30% chance of a 50-basis-point cut at one of these meetings. This has led to a volatile week, with the VIX Index approaching its highest level in nine months and the Nasdaq 100 experiencing swings of at least 1.4% over the past three days. The Magnificent Seven tech companies’ gauge was up 0.3% for the week through Thursday.

Advice: Mark Hafele of UBS Global Wealth Management suggests investors prepare for renewed volatility but avoid overreacting to short-term market shifts.

Bitcoin Dominance - BTC.D

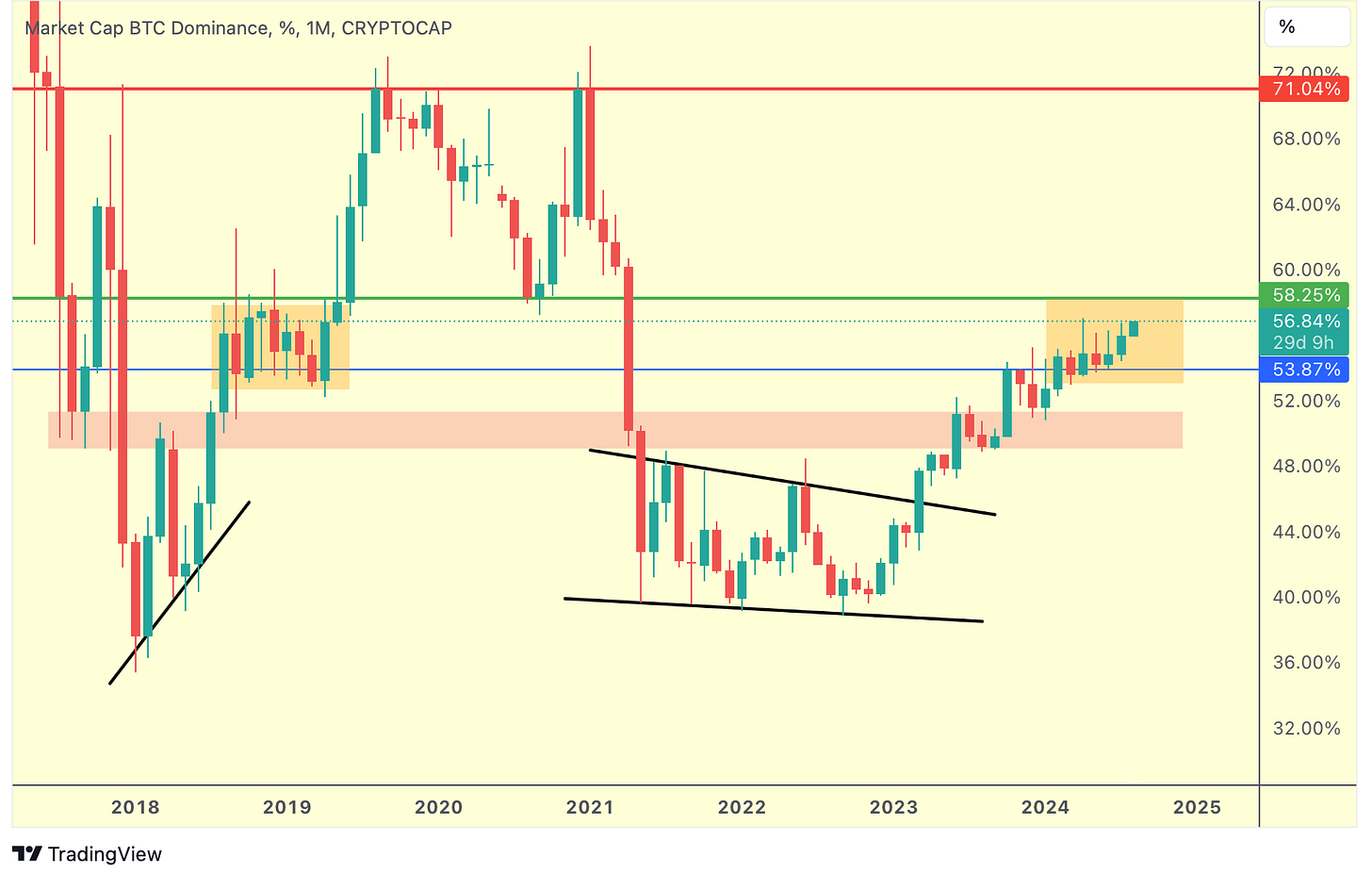

Bitcoin Dominance has been on the rise for three consecutive months now. Historically, when BTC.D trends upwards, Altcoins tend to struggle. We're eyeing the 58.25% mark closely. If Bitcoin Dominance breaks through this level, we could see a swift climb towards 71%, a pattern seen in late 2017, mid-2019, and mid-2020.

Until then, expect Bitcoin Dominance to stay in its current consolidatory phase, similar to the period from mid-2018 to mid-2019. A break above 58.25% could spell trouble for Altcoin valuations in the short term, but a subsequent drop from 71% would likely set the stage for "Altseason."

Trump & RFK Jr.

The Bitcoin 2024 conference in Nashville unexpectedly became a political hotspot. Former President Trump pledged to be a "pro-innovation and pro-Bitcoin president," promising to fire SEC Chair Gary Gensler on day one if elected. Meanwhile, Robert F. Kennedy Jr. proposed a strategic Bitcoin reserve, vowing to buy 550 BTC daily until reaching 4 million BTC.

These statements, though more political rhetoric than actionable policy, highlight the increasing significance of crypto in U.S. politics. Democrats are taking note, with some urging the party to embrace a more crypto-friendly stance. A group of Democrats even called for a pro-digital asset platform and a VP with digital asset expertise.

New Scam Alert

Stay vigilant! The FBI has issued a warning about "crypto exchange impersonation scams." Scammers are posing as exchange employees to steal your money. They create a sense of urgency and try to get your login credentials or personal information.

Tip: Ignore unsolicited calls and always verify any communication through official channels. For added security, consider using YubiKey for two-factor authentication—it’s much safer than SMS or app-based methods.

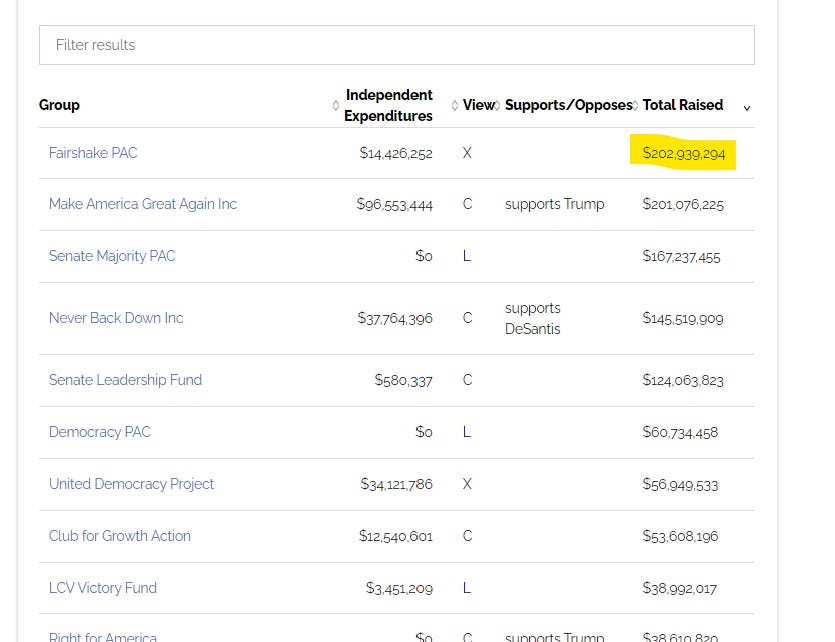

ETF Flows Paint a Pollock

The Ethereum ETF landscape is currently a mix of inflows and outflows. While overall net flows are negative at -$383 million, BlackRock’s iShares Ethereum ETF has seen strong interest, ranking among the top ETF launches this year. The outflows are mainly from the Grayscale Ethereum Trust (ETHE), reflecting a shift towards lower-fee options.

Layer 2s Take the Spotlight

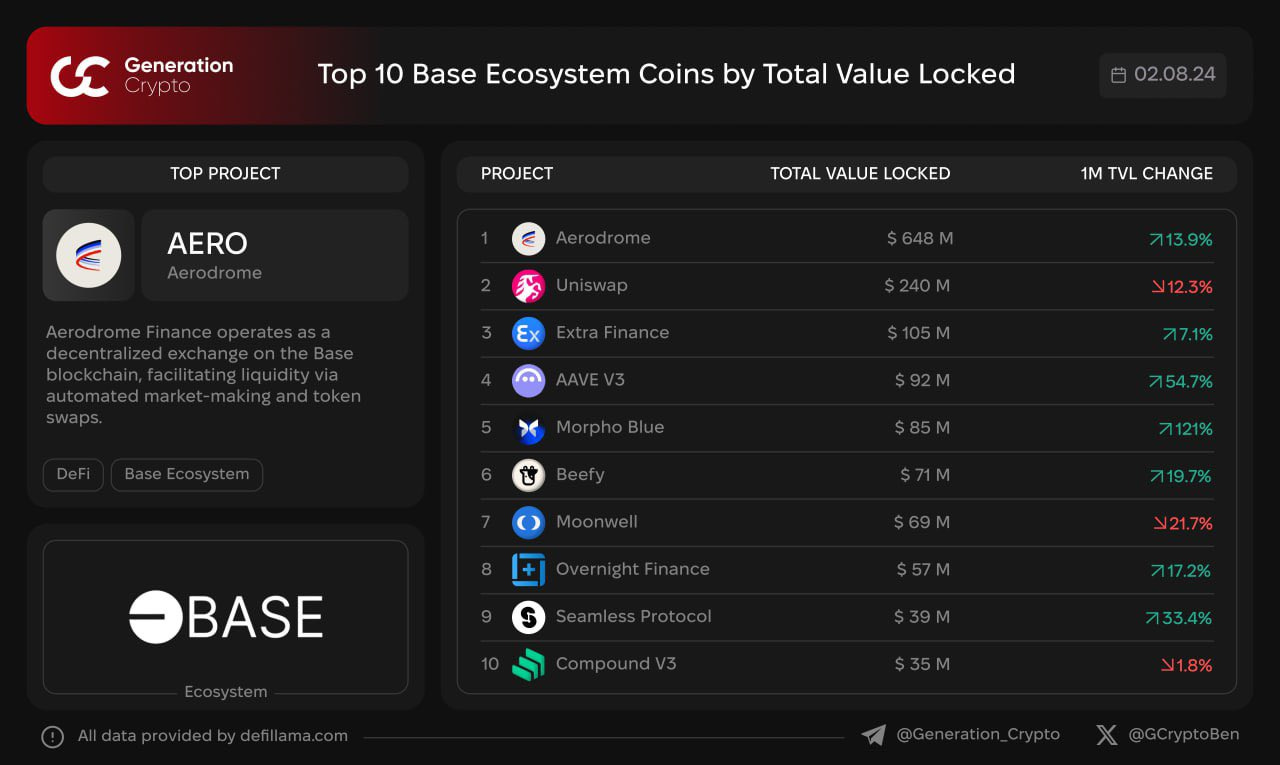

Ethereum's layer 2 solutions are gaining attention. The Eclipse network, known as "Solana on Ethereum," is now open to builders, offering Solana-like speeds with Ethereum’s security. Additionally, Coinbase's Base reported $20 billion in weekly USDC transfers, marking significant growth. Aerodrome (AERO) stands out with impressive Total Value Locked (TVL) on Base.

California Puts Car Titles on Avalanche

In a pioneering move, the California DMV has digitized 42 million car titles on the Avalanche blockchain. This step aims to streamline the title transfer process, reduce DMV visits, and cut down on lien fraud. The DMV app now lets you hold custody of your car title digitally—a long-discussed idea now becoming a reality.

In summary, while the market may be flat, the crypto world continues to advance in exciting ways. Keep an eye on these developments and enjoy your weekend!

The Strategic Reserve Bill Is HERE!

We’re excited by the opening line of the Strategic Bitcoin Reserve Bill: “This Act may be cited as the ‘Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide Act of 2024’ or the ‘BITCOIN Act of 2024.’”

One notable aspect is the provision: “Prohibition on Immediate Sale.—No digital asset stored in the Strategic Bitcoin Reserve that is the result of a fork or airdrop may be sold or otherwise disposed of during the 5-year period beginning on the date of the fork or airdrop, unless explicitly authorized by law.” It seems that Bitcoiners might prefer any non-Bitcoin assets in the reserve to be quickly exchanged for Bitcoin. According to the bill, the reserve will factor in the 200,000 BTC already held by the U.S.

The bill also outlines that: “The Secretary shall establish a Bitcoin Purchase Program which shall: (A) purchase up to 200,000 Bitcoins per year over a 5-year period, for a total acquisition of 1,000,000 Bitcoins.”

Additionally, it mandates: “Beginning on the date of enactment of this Act, any Bitcoin under the control of any Federal agency, including the United States Marshals Service, shall—(1) not be sold, swapped, auctioned, or otherwise encumbered; and (2) upon the acquisition of legal title to such Bitcoin, be transferred by the head of such Federal agency to the Strategic Bitcoin Reserve.”

Regarding the reserve’s release strategy: “On the date that is one year before the end of the minimum holding period under paragraph (1), the Secretary shall submit to Congress recommendations on whether to continue to voluntarily hold or to allow for the gradual and controlled release of a portion of the holdings of the Strategic Bitcoin Reserve.” Importantly, no more than 10% of the reserve can be sold within any 2-year period.

For financing the Bitcoin acquisition, the bill proposes several methods in section 9 to “offset the cost of the Strategic Bitcoin Reserve.” These include reducing Federal Reserve banks’ discretionary surplus funds from $6.825 billion to $2.4 billion, having Federal Reserve banks remit earnings to the U.S. Treasury, and revaluing Federal Reserve banks' gold certificates to reflect their fair market value.

Coindesk explains the revaluation plan as: “Within six months of the legislation’s enactment, Federal Reserve banks would tender all their outstanding gold certificates to the Treasury Secretary. Within 90 days after that, the Treasury Secretary would issue new gold certificates to the Federal Reserve banks that reflect the fair market value price of the gold.”

At this stage, the focus should be on securing co-sponsors and building momentum for the bill, with a key endorsement from Trump potentially providing a significant boost in traction and visibility before the election.

Cheers!

Recommended Reading: Are You Ready For DeFi Crypto Season?